August FX Market Report 2025

Naira Holds Steady In August

Nigeria’s foreign exchange market showed stronger signs of stability in August 2025. Supported by CBN interventions and a notable boost in FX reserves, the Naira held firmer ground even as oil prices slipped.

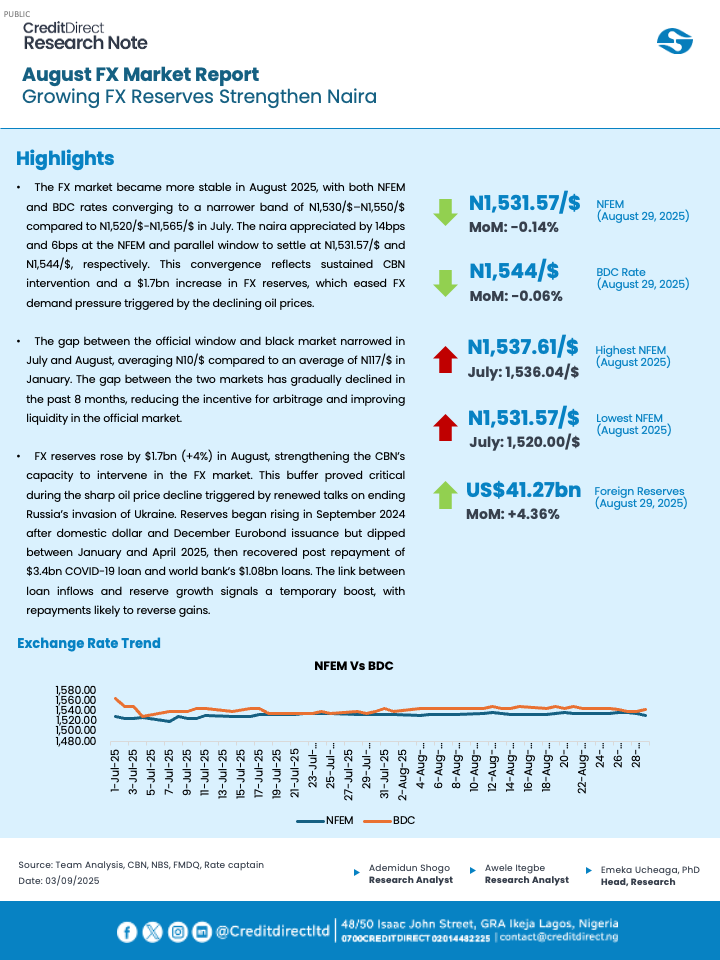

Narrower Trade Band

For the second month running, the Naira traded within a narrower band. Rates converged between ₦1,530/$ and ₦1,550/$, compared to the wider spread seen in July. At the official NFEM window, the Naira appreciated slightly to ₦1,531.57/$, while at the parallel market it closed at ₦1,544/$.

This convergence reflects growing market confidence and reduced arbitrage opportunities, thanks to CBN’s timely interventions and improved liquidity. At the same time, foreign reserves rose by $1.7 billion, reaching $41.27 billion by the end of August. This 4% increase gave the CBN more firepower to defend the currency despite lower oil prices.

However, much of this reserve growth is tied to loan inflows and Eurobond proceeds. While these provide short term relief, future repayments could erode the gains if not carefully managed.

Investor Confidence Builds

A firmer Naira is already attracting more investor interest. In the first seven months of 2025, foreign participation in equities surged by 117% to ₦1.67 trillion. Strong inflows were also recorded in fixed income, showing renewed trust in Nigeria’s markets.

Inflation Eases Slightly

Naira stability also helped ease import driven price pressures. Headline inflation slowed to 21.88% in July, with food inflation growth easing slightly compared to June. If this trend continues, it could provide relief for households and businesses navigating higher living costs.

What to Expect in September

Looking forward, CBN’s interventions and stronger reserves are expected to keep the Naira steady within a tight band in September, averaging between ₦1,535/$ and ₦1,550/$. But risks remain. Oil price swings, Eurobond maturities, and global monetary shifts could test this stability.

Still, the direction is clear. Nigeria’s FX market is entering a calmer phase, and the resilience seen in August offers cautious optimism for both investors and consumers.