September 2025: Monetary Policy Report

September MPR: CBN Begins Easing, Banks Brace for Impact

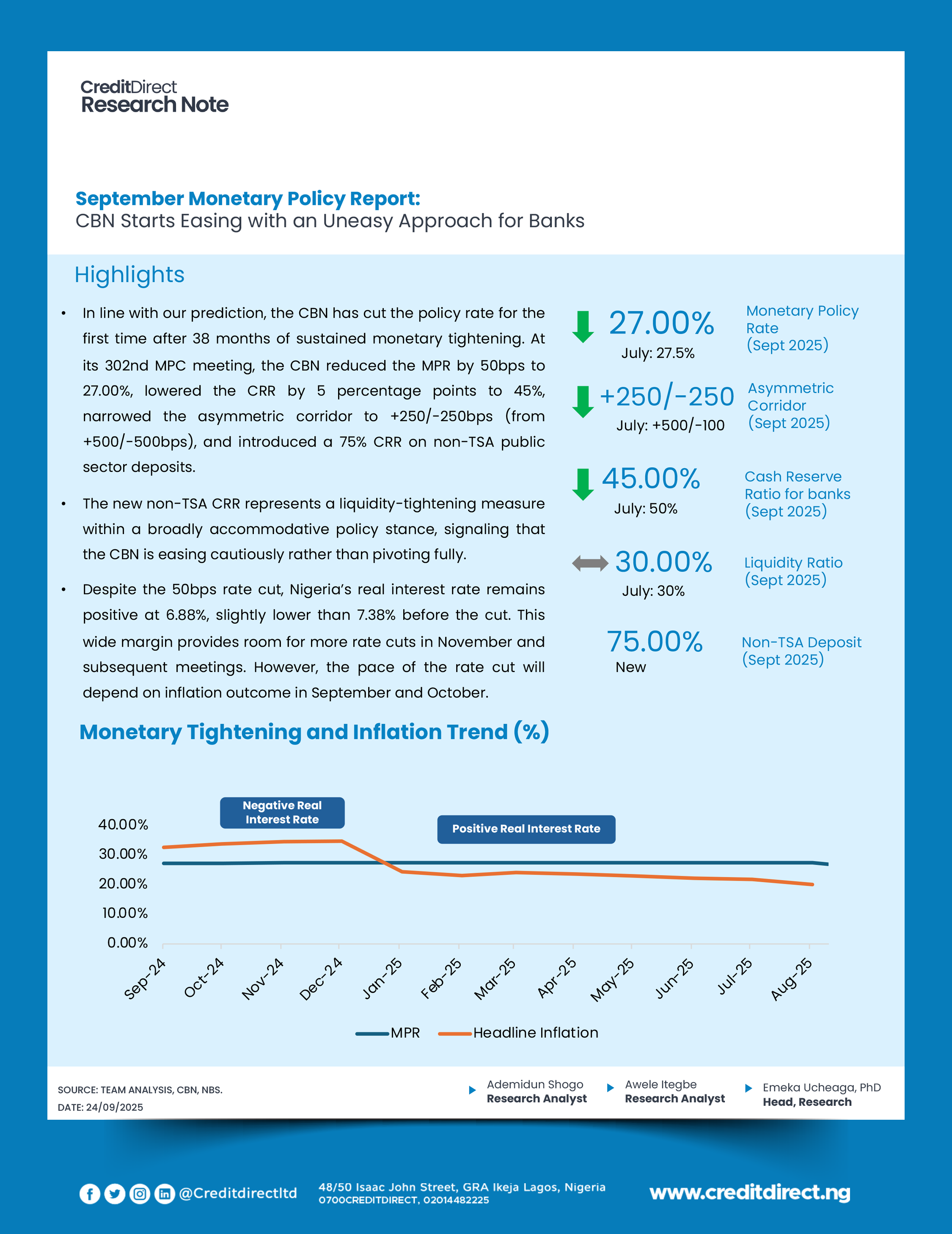

The Central Bank of Nigeria (CBN) has made its first policy rate cut in more than three years, signaling a cautious shift toward easing. At the 302nd MPC meeting, the CBN reduced the Monetary Policy Rate (MPR) by 50bps to 27.00% and trimmed the Cash Reserve Ratio (CRR) by 5 percentage points to 45%.

This move was widely anticipated as inflation pressures eased and naira stability improved. But the CBN chose a careful path, introducing a 75% CRR on non-TSA deposits to keep liquidity in check.

Highlights at a Glance

CBN’s first rate cut in 38 months was coupled with measures designed to stimulate lending while maintaining monetary discipline.

Despite the cut, Nigeria’s real interest rate remains strongly positive at 6.88%, giving room for further adjustments in November if inflation trends continue downward.

Why This Matters

The market had already begun anticipating a shift, with bond yields adjusting even before the MPC meeting.

The easing should make credit cheaper for businesses and households, while the narrowed corridor reduces borrowing costs from the CBN. Still, risks remain from food price shocks, insecurity, and global oil price volatility.

Looking Ahead

With inflation moderating by 436bps since January and reserves holding steady at $42.14bn, Nigeria is positioned for further cuts in November. If disinflation and FX stability persist, lending conditions could improve significantly, giving households and firms easier access to credit and boosting GDP growth into year-end.

P.S: The September Monetary Policy Report is also available for download